How a Chinese puzzle could enable the Greeks to have the last laugh

The other day Enda Kenny speculated aloud that Greece should follow Ireland. Michael Noonan thinks that too. Apparently, they should do what we did and, if Greece did, there’d be no problems.

Maybe we should examine this proposal because what is on the table for Greece right now makes little sense. Is there an alternative for an inventive Greece – one that might follow Ireland’s blueprint?

Before we answer that, let’s examine what’s on the table for Greece right now. The German/EU offer maintains that the price for staying in the Euro is possibly 10 to 15 years of austerity with no alternative industrial model. There should be no debt forgiveness and there should be years of low to zero growth as the Greeks grind out a meagre existence largely from tourist euros. Because there is no capital, this will occur at a time when Greek tourist assets will plummet and those that are worth something, such as tourist hotels, will be bought off by German and other investors for half nothing.

In time, the Greeks will end up as workers in the tourist industry, working for foreign owners of the assets. The profits from these assets will be repatriated back to Germany, boosting the German current account surplus, while the wages for this labour will be spent in Greece on imported goods, which may or may not be made in Germany. Basically Jamaica with ouzo!

Over time, the Greek standard of living will remain low and Greek people with talent will have no choice but to emigrate. There may be some pick-up in the economy but as long as there is huge debt-servicing costs, this pick-up will largely go to servicing past debts. If there is some new EU loan made available to Greece, this will simply be borrowing from tomorrow not to pay for today but to pay for yesterday.

The Greeks should do all this in order to have the privilege of paying for this stuff in the Euro. It seems a high price to pay for a currency, don’t you think?

But the alternative is, according to the EU, to revert to the drachma, watch the currency fall, watch the drachma value of Greece euro debts rise, allow the national balance sheet to implode and ensure that the banks collapse. In other words, flirt with short-term Armageddon.

All this would be for the privilege of using someone else’s currency.

But what if there is an alternative to the Euro? What if there is another option. What if the Greeks literally took the Irish example and went for it?

Think about it, what is the key difference between Ireland and Greece? The crucial difference is multinational investment. This is what makes Ireland tick. We are talking about someone else’s capital. Ireland has built an economy on using foreigners’ capital, manipulating our tax rates and creating a capital-intensive economy. This has propelled Irish living standards upwards.

This capital almost exclusively came from America.

Oh, and by the way, this industrial policy started in the late 1960s when we had a currency called the Irish pound. This was a pre-decimal currency, which dealt in half crowns and farthings. We abandoned this currency in the early 1970s for a decimal currency. Notes and coins were changed, denominations too. Both these currencies, the imperial and the decimal Irish pound, served us from Independence until 1979 and both Irish pounds were tied to Sterling.

Then we abandoned this currency and issued a new currency, the Irish punt, and linked it to a currency that most of us had never seen called the Deutschemark. This was the currency of a country the vast majority of us had never been to, one with which we did barely any trade with – apart from importing their cars. We pretended that the punt was a hard currency but in truth we couldn’t keep up with the Germans and we devalued six times. Then about 20 years later, we adopted another new currency, the Euro.

This means that Ireland used four different currencies in three decades! And all this time, what happened to American foreign investment? Did it fall as many people suggest in the face of currency instability? No, in fact precisely the opposite happened. American investment rose and rose.

During all these years, there was a very good reason for Ireland adopting the dollar as our currency but we didn’t. Had we asked the Americans, I’m sure they would have said yes because other countries using your currency is a real indication of your economic power. The Americans would have liked to project their power deep into the EU, who wouldn’t?

This is the Irish path – the path Enda Kenny would like Greece to follow.

Okay, but how can Greece get lots and lots of foreign investment into the country while still using a currency that is strong and in so doing, change irrevocably their economy?

How can they move onto a higher productivity level without all these debt repayments?

They can do it by adopting the Chinese Renminbi!

Yes, you read it right.

There’s no point for the Greeks in going back to the drachma if that will destroy its banking system.

Why not do what Ireland has done over the years and adopt some other country’s currency?

What’s in it for China? Everything!

The Chinese get a foothold into Europe. They invest billions into Greece, where they reassemble Chinese goods into Europe with no tariffs or hassle. They gradually move up the value curve, making ever more sophisticated goods in Greece – just as the Americans have done here.

They can even use the Greek tax system to reduce the taxes they have to pay, just like the Americans have done here. And, of course, it would be a massive diplomatic and geo-political coup for the Chinese.

Also, because the Greeks are allegedly Marxists and the Chinese are supposedly communist, they could brand this as a left of centre affair.

The Greeks would get a stable currency, lots of liquidity into their banking system and a currency backed by real economic logic. They would get industry and technology, so that the next generation of Greek kids could work in spotless hi-tech factories, exporting hi-tech consumer goods into Europe.

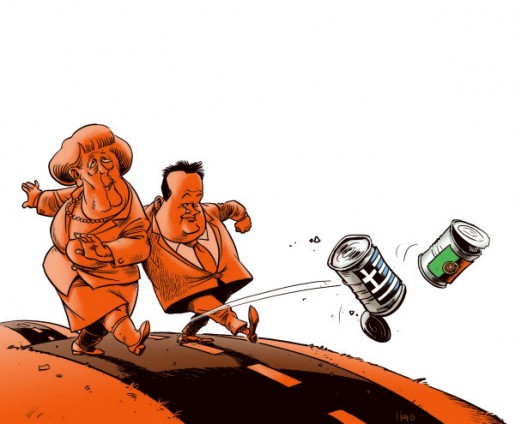

Oh yes, and lastly, who would lose most over a generation? Which European country has most to fear from its consumer goods being eviscerated by Chinese competition?

Why, Germany of course! Wouldn’t it be sweet revenge for Athens that, after being humiliated by the Germans, Greece would be the staging post for a commercial assault on Germany that would terrify the Bundestag?

Everything I have said above is doable, legal and possible within Greece’s membership of the EU.

After all, Sweden, the UK and Denmark don’t use the Euro and are in the EU, why not Greece?

I know this is mere conjecture at this stage. But if you push a country into a corner, it will do what it has to do to survive.

Economics is the art of the possible. It is about making a better future for your people and it is about doing business with whoever makes these objectives a reality.